Considering an IPO?

Going public can certainly raise the profile of a company, which may assist with winning new contracts or clients. As growth opportunities present, the share market will provide access to capital – as long as the business has been performing.

However, the IPO process and the public markets are surrounded by myths and uncertainty. From the perspective of a smaller company (<$100m market cap), which of the myths are true and which are false?

- Being a listed company provides founders with instant liquidity → OFTEN FALSE.

Once listed, strategic shareholders often need to identify another strategic buyer in order to sell their stake or undergo a marketing process similar to the sale of a private company. The alternative is to sell down over a long period (often several years). - After getting through the headache of the IPO process, life becomes easier → FALSE.

Management can easily underestimate the heavy demands of regulators, investors and auditors, once they are public. Directors also face a significant number of new responsibilities, some of which they are personally liable for executing. - Sophisticated institutions will provide support for my long-term vision → OFTEN FALSE.

Institutions manage a large portfolio of investments per team member. Their understanding of your industry is unlikely to match that of a trade player or value add investor; such as a private equity fund, which has a much more concentrated focus. Furthermore, their investment performance is assessed over relatively short time frames (e.g. annually).

In this newsletter, Toro Liberty will provide an update on changes to ASX listing rules, explore listing trends and suggest some explanation for the changes.

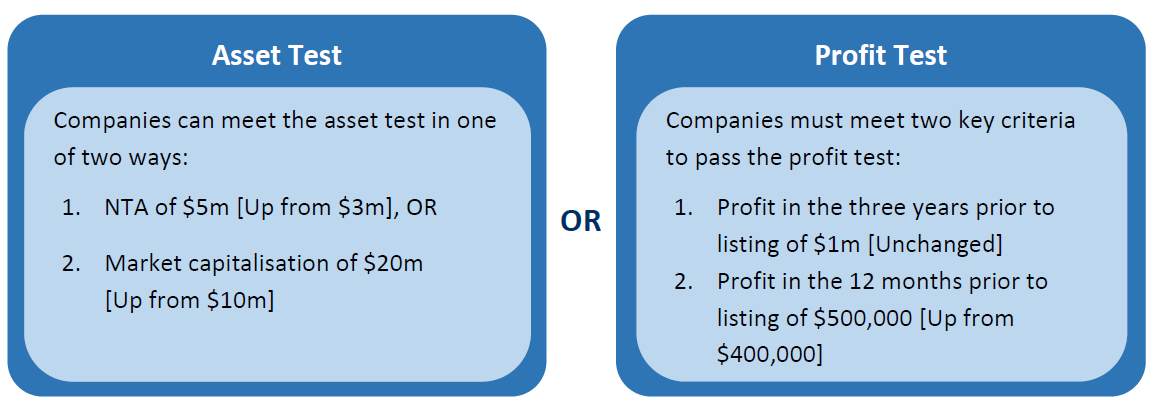

Proposed changes to ASX listing rules

There are many listing criteria, including two key financial tests

Companies applying to list must meet either the Profits test or the Assets test.

The criteria, under proposed changes, are as follows:

The key proposed change is to increase the thresholds for the asset test. In essence, the ASX is trying to make it more difficult for early stage companies to list, which are yet to establish a profitable track record.

The key proposed change is to increase the thresholds for the asset test. In essence, the ASX is trying to make it more difficult for early stage companies to list, which are yet to establish a profitable track record.

What has driven these changes?

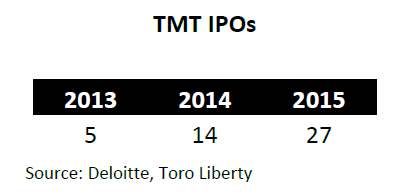

Another big change in recent years has been the fall of Resource company IPOs, and the rise of TMT (Telecom, Media and Technology).

Whilst many of these IPOs were very large initial successes, the reality of investing in high risk, early stage technology businesses has hit home for many investors. For example, Reffind Ltd issued shares at 20c, subsequently they soared to $1.96, before falling back to trade at less than 15c. Another example is Rewardle which listed at 20c, but now trades around 7c, and has traded less than $10,000 per day for the past 3 months.

Smaller, less established companies are higher risk in general, and it is these IPOs that the ASX is concerned with.

Recent IPO Trends?

Whilst many business owners may once have dreamed of floating their company, several factors have kept new listings to half of pre-GFC levels. The number of listed entities has also flat lined.

The trend can also be seen in the United States, where a combination of M&A activity and a decrease in IPO activity has led to a significant fall in the number of listed entities.

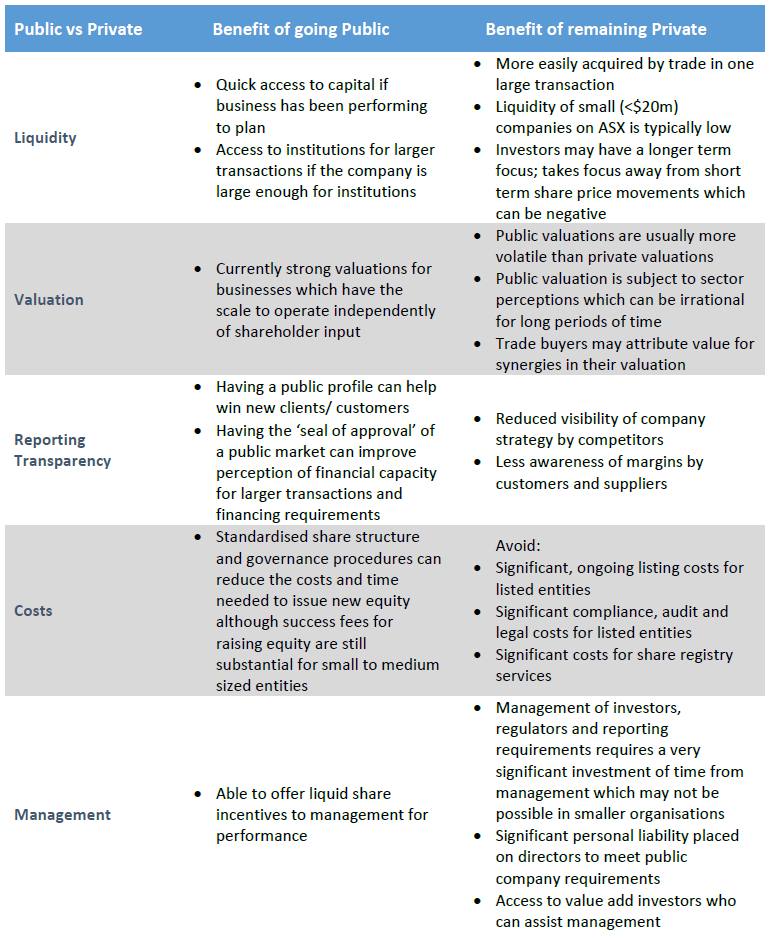

What drawbacks should I consider before deciding on an IPO?

Given that listing volumes in Australia still haven’t recovered to pre-GFC levels, and the number of listed entities in the US has dropped to multi-decade lows, there must be some drawbacks to floating your business.

At Toro Liberty, many of the companies we speak to are within the $10m-$50m valuation range. At this scale it is often uneconomical to support several layers of management. However, a lean management team may struggle if swamped by the regulatory and reporting requirements of being listed.

For those companies who plan to grow rapidly and require frequent access to capital, the share market may be appropriate, even at the smaller end. But for more stable companies whose founders plan to retain a significant stake, the financial costs of being listed may not outweigh the benefits. Liquidity for small, tightly held companies is often lower than people expect, and any hiccups may cause investors to lose confidence in a company and punish the share price for significant periods of time. This can further reduce liquidity and make raising capital more difficult.

All the best in the new financial year.

Toro Liberty